My family owns an SFR in a really incredible neighborhood of Bethesda, MD, built in the early 50s. We’ve been trying to determine whether to renovate or rebuild.

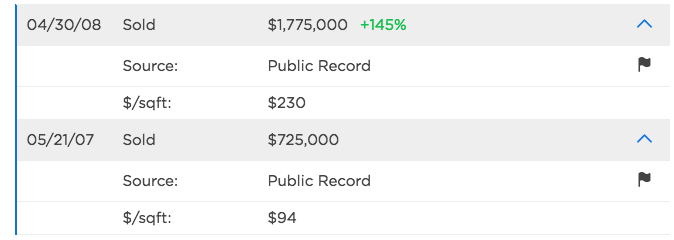

There have been a lot of rebuilds taking place in the neighborhood over the past decade or so and to get a better sense for the ROI of one, I took a look at a property down the street. Checking the transactional history, I was able to quickly see how it was purchased in 2007 for $725K and then sold less than a year later for $1.8M.

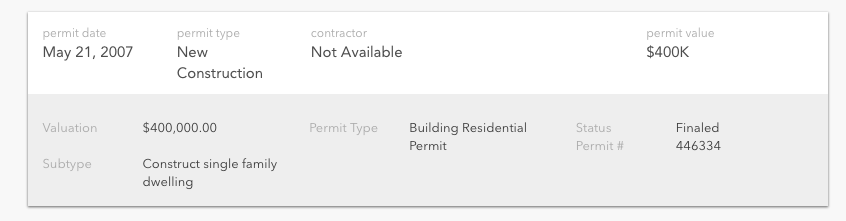

To quickly determine the investment that resulted in this return, I simply looked up the construction records on BuildZoom to get a sense for the valuation of construction put in place (around $400K).

I acknowledge this is a rudimentary method and probably requires a bit more discovery, however it does provide a good heuristic that can help inform the decision to renovate an existing structure or simply rebuild, based on the actual value created through the construction project, which is made pretty clear based on the transactional records.

0 Comments on "How BuildZoom data can inform real estate investment decisions"